On February 5, the Federal Reserve Board released the hypothetical scenarios for DFAST 20251. All scenarios run from the first quarter of 2025 through the first quarter of 2028. This... read more →

On February 15, the Federal Reserve Board released the hypothetical scenarios for DFAST 2024 and an exploratory analysis1. The latter can lead to integrated stress testing and potentially become a... read more →

The results of the 2023 Federal Reserve stress test announced on June 28 indicate the 23 largest banks would experience substantial losses under the severely adverse scenario, $422 billion in... read more →

In an earlier post we looked at the DFAST 2023 scenarios and their expected impact on loss forecasts compared to last year's scenarios. How does the DFAST 2023 severely adverse... read more →

On February 9, the Federal Reserve Board released the hypothetical scenarios for DFAST 2023.1 The scenarios run from the first quarter of 2023 through the first quarter of 2026. This... read more →

The Q2 data releases for GDP and Consumer Spending (personal consumer expenditures) within the last couple of days validated two of our recent predictions regarding Residential Investment and Consumer Spending.... read more →

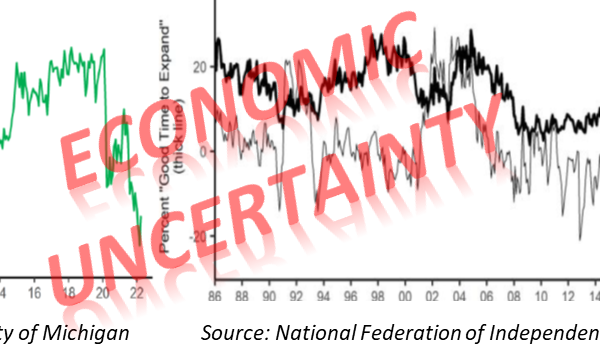

The four figures below are indicating that the U.S. economy might already be in recession! The top two figures are showing rising consensus for a recession in the next 12... read more →

The 2022 DFAST stress test results were released by the Federal Reserve Board (FRB) on June 23. In this article we first provide a summary of the results including a... read more →

Several large U.S. banks have been reporting 1Q2022 earnings in the last two weeks. What are some of the key themes from these reports, and what could they imply for... read more →

On February 10, the Federal Reserve Board released the hypothetical scenarios for CCAR 2022: The Fed - 2022 Stress Test Scenarios (federalreserve.gov) This year, 34 large banks will be tested... read more →