In an earlier post we looked at the DFAST 2023 scenarios and their expected impact on loss forecasts compared to last year’s scenarios.

How does the DFAST 2023 severely adverse scenario compare with the European Banking Authority’s (EBA) 2023 adverse scenario announced on Jan. 31?

A recession is incorporated in both scenarios:

- In EBA adverse scenario real GDP at the EU level declines by 6% cumulatively over the three-year horizon, while the unemployment rate increases by 6.1 percentage points, both relative to the starting point.

- In DFAST severely adverse scenario real GDP declines by 5.3% cumulatively over the same period, while the unemployment rate increases by 6.4 percentage points relative to the starting point.

However, besides the above similarities in the two recessionary scenarios, the EBA one also reflects stagflation due to “severe geopolitical polarisation that will initiate a process of partial deglobalisation of the world economy”. According to this scenario, this would result in high current and expected inflation triggering expectations of further policy reactions, leading to higher market interest rates – with adverse financial and real consequences.

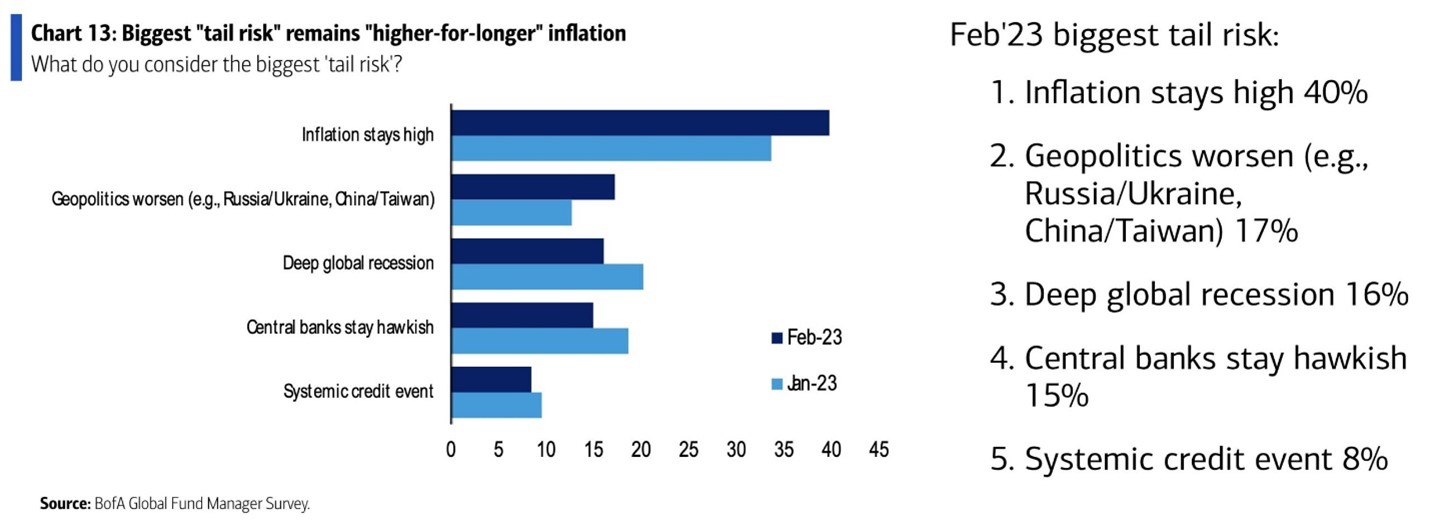

In fact, according to Bank of America’s Global Fund Manager survey, released on 02/14, the biggest tail risk to the US economy is persistent high inflation, see top chart below, which would most likely cause the Fed to raise rates at a more aggressive pace. Furthermore, stagflation is still the most likely macro backdrop in the next 12 months, with 83% of the survey participants expecting below-trend growth and above-trend inflation.

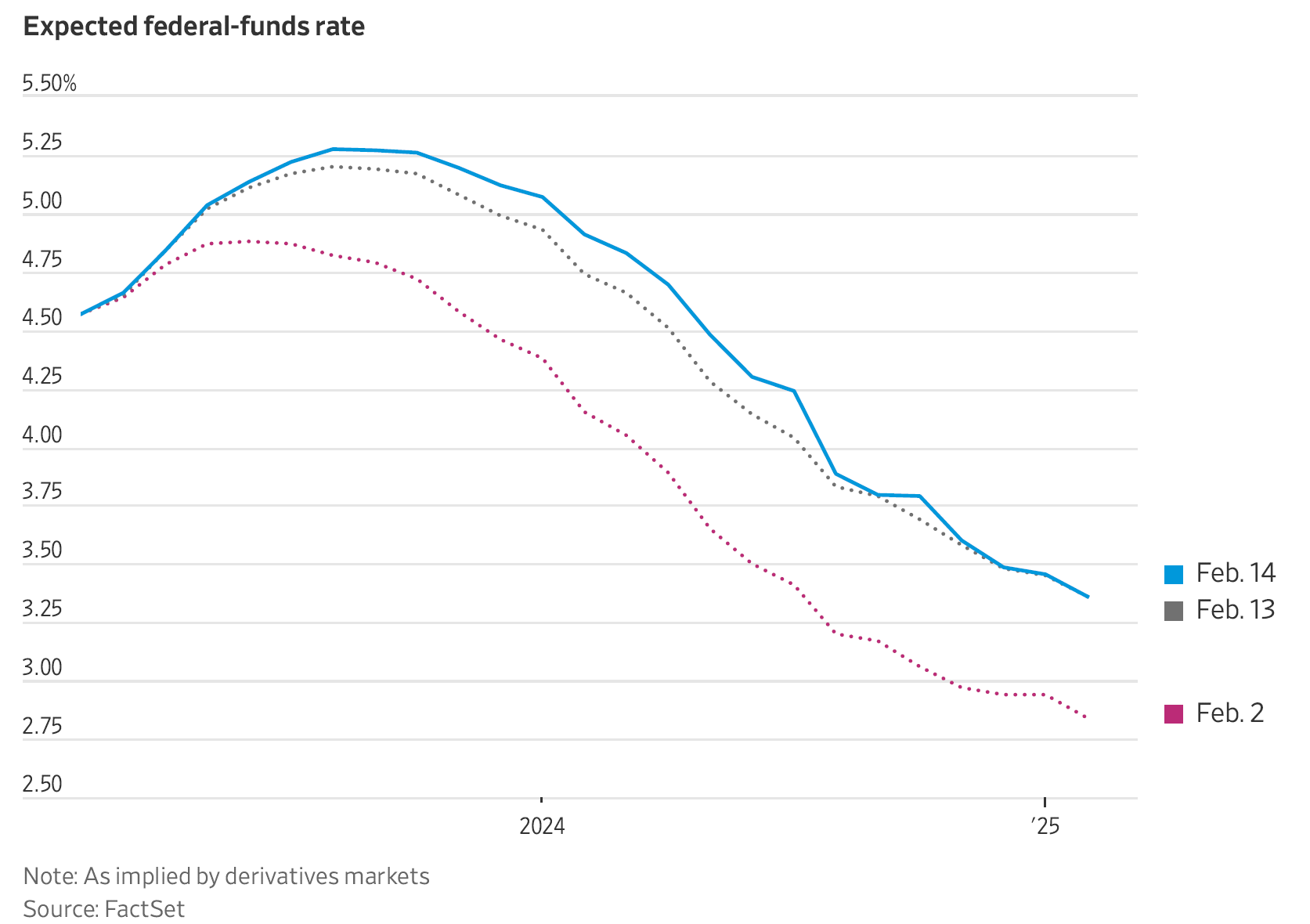

US consumer price data for January showed inflation slowed slightly but came in above forecasts, February 14th release from U.S. BLS. As a result, the market implied terminal Fed Funds jumped that day to above 5.25%, as per bottom chart below.

In DFAST 2023, neither the baseline nor the severely adverse scenarios reflect any persistence in inflation. In the severely adverse scenario CPI falls to below 2% by Q2 2023 resulting in easing of the monetary policy and a significant drop to short term rates.

In contrast, in EBA adverse scenario inflation initially increases to 9.7% in 2023 and drops thereafter (5.3% in 2024 and 3.8% in 2025) but remains high compared to historical levels. Short-term market rates markedly increase as a result.

However, the Federal Reserve for the first time this year is also including an additional, exploratory market shock component (the exploratory market shock) that will be applied only to U.S. global systemically important banks (G-SIBs), 8 banks in total. This exploratory scenario is characterized by a less severe recession, compared to the severely adverse scenario, but with greater inflationary pressures induced by higher inflation expectations.

Although this exploratory scenario will not contribute to the capital requirements set by this year’s severely adverse scenario, the Federal Reserve introduced it so that “…differences in scenarios could reveal different losses across banks, depending on the positions held in their portfolios”. The exploratory scenario contains the paths for interest rates, credit spreads and commodities.

It is expected that firms will apply these risk factor shocks to produce the profit and loss (P/L) estimates for the trading and counterparty credit (CCR) portfolios.

- How does this exploratory market shock affect the real economy and therefore the banking book of a bank?

- What about impact on specific asset classes, e.g. CRE, and geographies?

Of course, it should be pointed out the above scenarios are purely hypothetical and are meant for specific regulatory capital adequacy testing.

- Nevertheless, we would highly recommend that banks enhance their capital adequacy testing with recessionary scenarios that include stagflation and a higher-for-longer stance from the Fed as the latter can trigger significant effects on credit and interest rate risks as well as banks’ earnings.