The results of the 2023 Federal Reserve stress test announced on June 28 indicate the 23 largest banks would experience substantial losses under the severely adverse scenario, $422 billion in loan losses vs. $383 billion in the 2022 stress test, but would maintain capital ratios well above minimum risk-based requirements.

The 2023 severely adverse scenario is characterized by a severe global recession accompanied by a period of heightened stress in commercial and residential real estate, particularly when compared to the 2022 stress scenario (see also DFAST vs. EBA 2023 stress scenarios | InfoAgora for a more detailed comparison of the two sets of scenarios):

- House prices bottom in Q4 2023 at (-33%), a value much lower (-33%) than the 2022 scenario

- CRE price index bottoms in Q4 2024 at (-29%), slightly lower than in the 2022 scenario.

The chart below shows a breakdown of the total projected losses by asset class in 2023 vs. 2022. The breakdown looks similar in the two years except for First-lien mortgages and Credit Cards that had higher share of projected losses.

- First-lien mortgages had losses that accounted for a significantly higher percentage of the total losses under the 2023 severely adverse scenario compared to the 2022 scenario.

In dollar value, the losses from First-lien mortgages for the 23 largest banks were $34.6 billion in 2023 vs. $14.6 billion in 2022.

- Despite the severity of the 2023 scenario for CRE prices, the share of losses for CRE was the same in 2023 as in 2022.

In dollar value, the losses from CRE for the 23 largest banks were $64.9 billion in 2023 vs. 64.2 billion in 2022, thus just marginally higher. The chart below compares the distribution of CRE loss rate amongst 23 largest banks in 2022 vs. 2023. The average CRE loss rate in 2023 (8.7%) is lower than the one in 2022 (9.8%) but the difference is not statistically significant.

Of course, the above comparison looks at losses from CRE loans overall, regardless of the real estate asset class. In addition to the decline in CRE prices, the 2023 severely adverse scenario noted that “declines in CRE prices should be assumed to be concentrated in properties most at risk of a sustained drop in income and asset values: offices that may be affected by remote work or hospitality sectors that continue to be affected by reduced business travel.”

Although the average CRE loss rate for the 23 largest banks is lower in 2023 than in 2022, the average office loss rate under this year’s scenario was close to 20% and was higher than the projected office loss rates of the last few stress test cycles as depicted in the chart below from the Federal Reserve’s stress result report. Furthermore, the projected loss rates of the last few years have been higher than the peak loss rate observed in CMBS Office during the 2007-09 Global Financial Crisis.

What do the 2023 stress test results imply for the rest of U.S. banks?

According to the latest Federal Reserve’s Financial Stability Report, banks hold about 61% of nonfarm nonresidential CRE loans, of which more than 70% are held by banks other than Category I-IV banks. Furthermore, banks hold $720 billion of office and downtown retail CRE with more than 70% held by banks other than Category I-IV banks. Office buildings and downtown retail properties have been highlighted as higher risk in the Financial Stability Report.

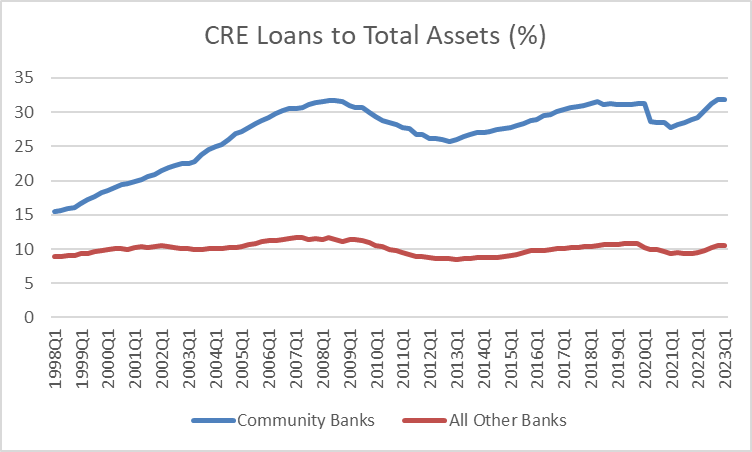

The chart below also compares the ratio CRE Loans to Total Assets of Community Banks with All Other Banks based on Call Report data. The ratio of Community Banks is 3 times that of All Other Banks.

Thus, smaller banks should use the above CRE and CRE Office loss rates as benchmarks for their own stress testing. In addition, regional and community banks should use relevant scenarios for their stress testing, by adapting the supervisory scenarios to the geographical footprint and asset classes of the bank. This is a crucial step that we follow for our clients, given the asymmetry in the impact and recovery from the severely adverse scenario shock across geographies and asset classes.

Grigoris Karakoulas is the president and founder of InfoAgora (infoagora.com) that provides risk management consulting, predictive risk analytics, price optimization, scenario generation and integrated stress testing solutions, and model validation services. Contact him at grigoris@infoagora.com