As US banks earnings season for Q1 2023 kicks off on Friday April 14, we look at trends in banks’ balance sheets. In light of the recent bank crisis, we distinguish between Large (top 25) and Small domestically chartered commercial banks.

In the January 2023 Senior Loan Officer Opinion Survey (SLOOS) on Bank Lending Practices by Federal Reserve, respondents on balance reported tighter standards and weaker demand for loans, particularly for commercial and industrial (C&I) ones. Furthermore, in the March 2023 Banking Conditions Survey by the Dallas Fed, bankers reported weak loan demand and tighter standards across all types of loans.

Figure 1 depicts the monthly change of loans and leases in bank’s credit according to Fed’s H.8 release of the aggregate balance sheet of Large and Small domestically chartered commercial banks. Loans and leases in Large banks were not significantly affected in March, whereas loans and leases in Small banks recorded the Largest monthly drop since the Great Financial Crisis, at -$46B.

- Which asset class drove the significant drop in loans and leases of Small banks?

Figure 2 depicts the monthly change of CRE loans. The latter was the asset class mainly responsible for the overall drop in loans and leases for Small banks in March. Moreover, Multifamily was the class driving the drop in CRE loans in March as shown in Figure 3.

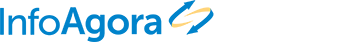

This is consistent with a recent report from WSJ that housing is turning out to be a lousy shelter for investors. Thus, Apartment prices are down 21% over the past year, according to the Green Street Commercial Property Price Index, just below Office at -25% as shown in Figure 4.

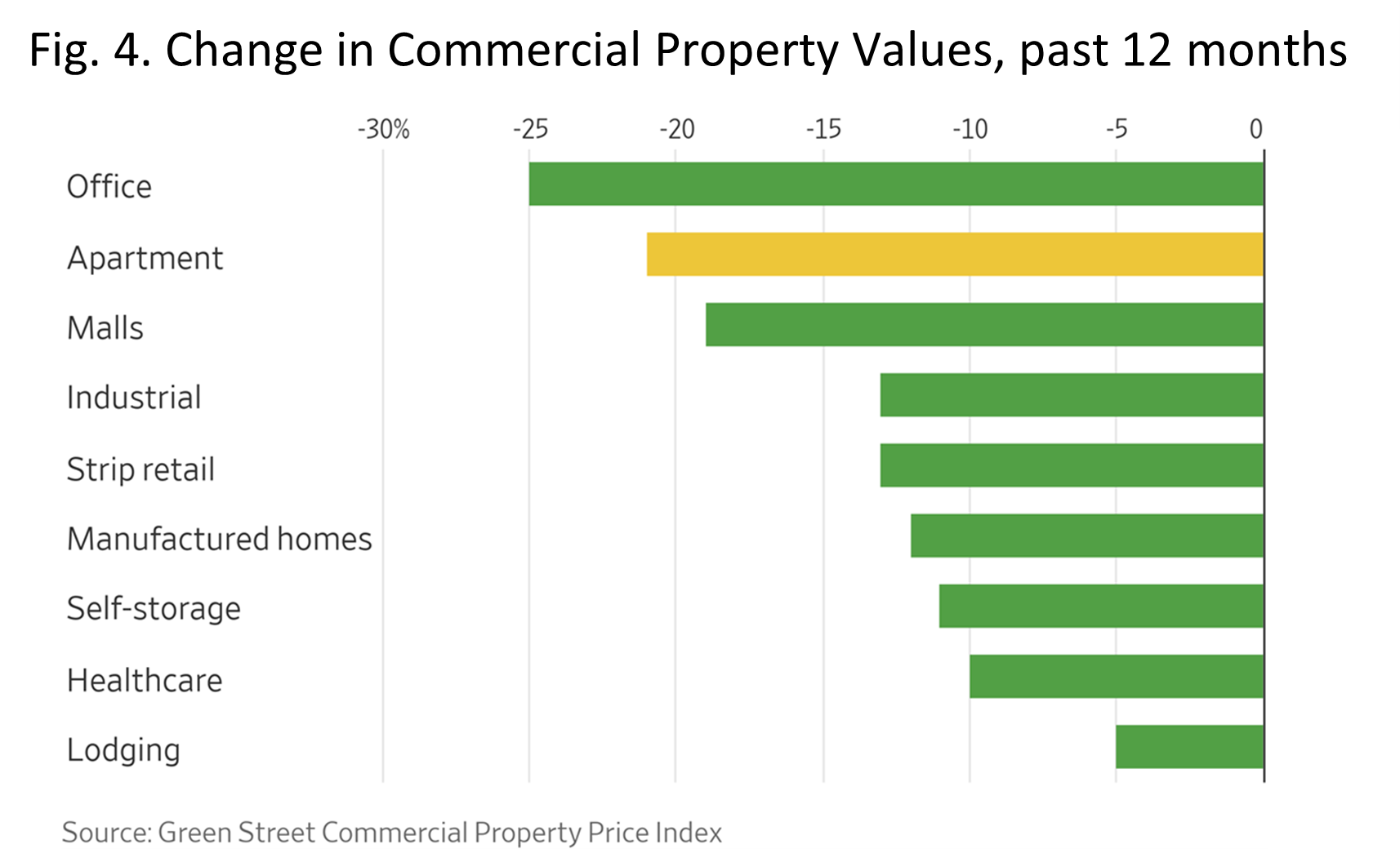

Figure 5 depicts the monthly change in C&I loans. Both Large and Small banks recorded a negative monthly growth in C&I loans in March, with Small banks exhibiting a bigger drop than Large banks.

We expect this negative growth in C&I loans to continue based on the tighter lending standards and weak demand for C&I loans reported in the aforementioned surveys.

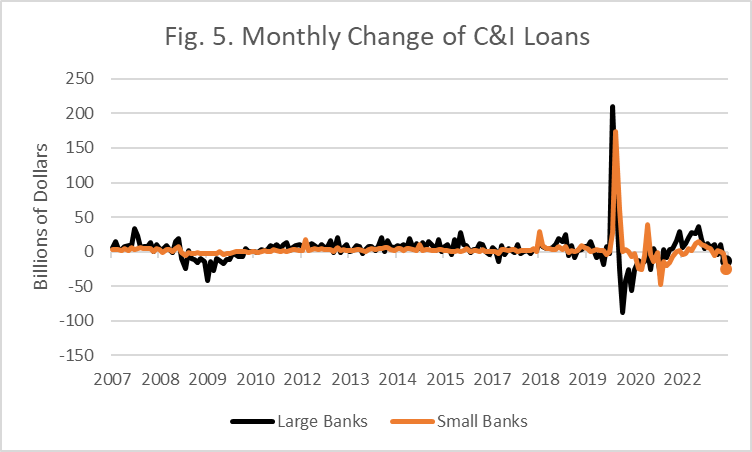

For example, based on a simple regression with the lending standards for C&I loans lagged by 4 quarters as the sole predictor of Y/Y growth in C&I loans at Large banks, the growth in C&I loans may turn negative before yearend. This is shown with the dashed orange line in Figure 6.

On the other side of the balance sheet, deposits in Small banks in March recorded their biggest monthly drop since the Great Financial Crisis, at about -$186B, as depicted in Figure 7.

Concluding Remarks

- The tightening lending standards seem to have had bigger negative impact on the credit growth of Small banks than Large banks, particularly for CRE and Multifamily loans.

- The tightening lending standards may also result in negative credit growth for C&I loans at Large banks by yearend.

- The negative credit growth in Small banks combined with the drop in deposits are expected to put pressure on the profitability of Small banks in aggregate.