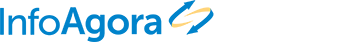

The four figures below are indicating that the U.S. economy might already be in recession!

The top two figures are showing rising consensus for a recession in the next 12 months. The bottom two figures are depicting forecasts for Q2 GDP from two Nowcast GDP models, from the Atlanta Fed and Bloomberg Economics.

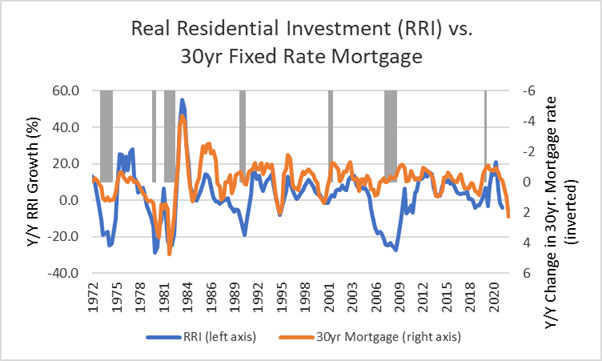

As we are waiting for next week’s release of Q2 GDP, one component of GDP that is expected to act as a drag on the overall figure is residential investment. This is because how sensitive residential investment is to interest rates.

The figure below shows that the y/y growth of real residential investment correlates well with the y/y change in the 30yr fixed rate mortgage when lagged by two quarters (inverted on the right axis). Thus, given the significant y/y rise in mortgage rates in the last two quarters, we expect real residential investment to exhibit negative growth in the coming quarters, between -5% and -15%.

Such negative growth in residential investment will have implications not only for the job market but also for U.S. small banks. The segment of residential construction loans has been amongst the top 3 segments with the highest quarterly growth for U.S. small banks (banks not in the top 25) in the last four quarters.

Of course, there are also other emerging risks to the CRE market – including rising spreads, rising costs and changes in tenant and consumer preferences – that could have a significant negative impact on CRE loan performance.

- How can banks best assess and prepare for these emerging risks?